One

day early this August, Mitt Romney gripped a microphone at the Iowa

State Fair, faced a crowd of a few hundred people, and began, a little

joylessly and therefore a little rapidly, to give a speech. It is the

opinion of some of Romney’s friends, some of the men with whom he made

his fortune, that the repetitive business of campaigning simply bores

him and that this boredom is responsible for the fairly sizable gap

between the charismatic man they know in private and the battery-powered

figure who often appears in public.

Romney, of course, is

not the only person bored by Romney’s campaign appearances, and in the

glazed reaction of the crowds you can see some skepticism about whether a

candidacy predicated on bringing a businesslike efficiency to the

WhiteHouse—a candidacy, basically, of process—could be something to

rally around. “Over the coming decades,” Romney said at the fair, barely

pausing between each idea, “to balance our budget and not spend more

than we take in, we have to make sure that the promises we make in

Social Security, Medicaid, and Medicare are promises we can keep. And

there are various ways of doing that. One is we could raise taxes on

people …”

“Corporations!” a man cried out from

the midst of the crowd. Romney was halfway through his next sentence,

but he stopped and pivoted, noticing the hecklers, one of whom (it

turned out) was a 71-year-old former Catholic priest from Des Moines.

Morality incarnate. “Corporations!” a heckler cried again.

Romney grinned.

“Corporations are people, my friend,” he said, neatly, flatly, and

looked back to the crowd, eager to press on. Suddenly there were loud

objections coming from all over, catcalls and cries of disbelief. But

the cameras detected a splash of interest on Romney’s face.

“Of course they are,”

Romney said, and he began to explain his logic. “Everything

corporations earn ultimately goes to people. So—” Another heckler

started ostentatiously laughing, a kind of mock disbelief. The

candidate tried another tack. “Where do you think it goes?” Romney said.

“In their pockets!” someone cried out.

Romney was already a step ahead. “Whose pockets?” he said, now almost gleeful. “Whose pockets?

People’s pockets! Okay.

Human beings, my friend!”

In his quick, casual

reply—corporations are people—Romney had seemed to give something away,

though it wasn’t immediately clear what. The press chose to play the

episode as a “gaffe,” as ABC’s Jake Tapper described it, a moment in

which the weakness in Romney’s political pitch, the gap between his own

privileged experience of the world and that of working-class voters, had

been exposed. MSNBC, in a spate of giddy incredulity, seemed to keep

the clip on loop for a week. But Romney’s own campaign managers did not

try to obscure the episode at the state fair, to say he had been

misunderstood or to secret it away. Instead they promoted it, as an

advertisement of principle, and made the confrontation the centerpiece

of a solicitation to supporters. A few days later, Romney’s

communication director, Gail Gitcho, told the press that the exchange

had raised $25,000 within 24 hours.

The incident, in

retrospect, did less to peg Romney as a creature of privilege than it

did to reveal something deeper. For Romney, the corporation has long

been an object of a certain idealism. It is something he has spent much

of his adult life—first as a management-strategy consultant, then as CEO

of the private-equity firm Bain Capital—working to perfect, to strip of

its inefficiencies until it might function as a perfectly frictionless

economic unit.

The political

genuflection to businessmen is so gauzy and generic that praise for a

candidate’s private-sector acumen can often sound phony. But Mitt Romney

is the real thing. He was, by any measure, an astonishingly successful

businessman, one who spent his career explaining how business might

operate better, and who leveraged his own mind into a personal fortune

worth as much as $250 million. But much more significantly, Romney was

also a business revolutionary. Our economy went through a remarkable

shift during the eighties as Wall Street reclaimed control of American

business and sought to remake it in its own image. Romney developed one

of the tools that made this possible, pioneering the use of takeovers to

change the way a business functioned, remaking it in the name of

efficiency. “Whatever you think of his politics, you have to give him

credit,” says Steven Kaplan, a professor of finance and entrepreneurship

at the University of Chicago. “He came up with a model that was very

successful and very innovative and that now everybody uses.”

The protests going on

at Zuccotti Park now have raised the question of whether that transition

was worth it. What emerged from that long decade of change was a system

that is more productive, nimble, and efficient than the one it

replaced; it is also less equal, less stable, and more brutal. These

evolutions were not inevitable. They were the result, in part, of

particular innovations developed by a few businessmen beginning a

quarter century ago. Now one of them has a good chance of becoming

president.

|

Mitt Romney and Bill Bain, a founder of Bain & Company.

(Photo: Justine Schiavo/The Boston Globe/Getty Images)

|

Right

now, a decade into the 21st century, the character of the management

consultant is so ubiquitous a part of the global economy that McKinsey

more or less guards the gate of the modern financial world. There is a

study currently concluding in India, for instance, in which Accenture

consultants are parachuted in to village textile factories, while a

control group of factories is being kept virtually consultant-free, to

see how much the strategists can improve operations. (The early results

look good for the consultants.)

But in 1975, when Mitt

Romney graduated in the top 5 percent of his Harvard Business School

class, consulting was still a novel field. As Walter Kiechel’s

entertaining history

The Lords of Strategy documents, the three

most prestigious consultancies (then, as now, McKinsey, the Boston

Consulting Group, and Bain & Company) believed they were bringing a

newly sophisticated, quantitative approach to business, using theories

and techniques to help American industry modernize. They regarded

themselves as intellectuals, and they also paid better than anyone

else—this being a decade before Wall Street salaries started to really

climb—and so Romney made what was, at the time, an obvious career

choice. He became a consultant, first at the Boston Consulting Group and

then, three years later, at Bain & Company.

The Bain & Company

consultants who traveled the circuit of American business in the late

seventies and early eighties experienced a mass of frustrations. The

efficient, data-driven theory of business the consultancies had

developed did not in any real way cohere with the practice of business

that they saw in executive suites in St. Louis, Rochester, Houston. The

theory said that companies should focus on their core business, but

everywhere corporations were developing misguided plans to become

conglomerates. The theory said management should measure everyone’s

productivity in a firm, down to the lowliest employee, and every last

worker should be rewarded or punished depending upon his performance,

but the social relationships of business seemed to have decayed into a

long, amicable golf-course lunch. There was a loyal, almost

paternalistic attitude toward workers, protecting them even when they

seemed to be drags on growth. When I interviewed Romney’s early

colleagues about the business world that they surveyed during this

period, they tended to adopt an attitude of high disdain. “Sloppy,” one

told me. “Complacent,” said another. “Lazy,” said a third, “and out of

tune with the change that was going on in the world.”

These men are still

around—it is an unusually small and tight group, and many of them have

continued to work on and off for Romney as he has moved into public

life. They are mostly immensely rich, and if they give a collective

impression, it is tanned, engaged, upbeat, as if it is always 8 a.m. on a

Saturday and they are the fathers of shortstops. But when they began

their careers, in their own telling, they were outsiders on the make.

“If you think about that era—I grew up in the sixties and

seventies—business wasn’t a particularly noble profession,” Geoffrey

Rehnert, an early Bain partner, told me. “The best brains went into

medicine, the next best went into law.” American business, he said, “had

a thinner bench.” Those who gravitated to Bain built a culture that was

“not entitled at all. Not a single person was born with money in their

family. Every single person came from a blue-collar or middle-class

background.”

“Except for Mitt,” I

said. (Romney’s father had been the head of American Motors

Corporation, the governor of Michigan, and a member of the Nixon

cabinet; there is no credible way to describe the American elite that

excludes Mitt Romney.)

“Even he didn’t come from affluence,” Rehnert insisted. “He wasn’t a trust-fund guy.”

Perhaps what he meant

was: Romney wasn’t a Wasp. He never really talked to his co-workers

about his Mormonism, but he sometimes joked with Jewish colleagues about

how their religions made them all outsiders. Even for those who worked

with him, Romney had an inscrutable quality: They never cursed around

him and didn’t drink, and they understood that his social life would be

his family life. “I always felt that Mitt viewed himself as one of the

chosen few,” one of Romney’s colleagues at Bain Capital told me. “I

don’t think it ever affected his decision-making, but there was that

overhang.” Romney was, in the late seventies and early eighties, heavily

involved in Bain’s recruiting, and this is how many of his cohort still

view him, as a handsome guy with a great handshake. Bill Bain, the

consultancy’s titular founder, once told the New York

Times that Romney seemed a decade older than he actually was.

|

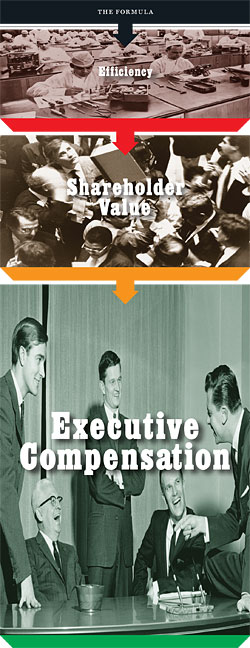

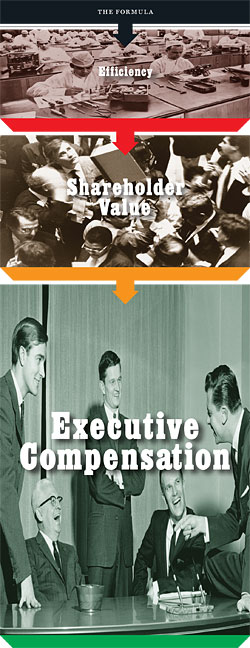

(Photo: From top, Superstock/Getty Images; Anthony Pescatore/NY Daily News Archive/Getty Images; Superstock/Getty Images)

|

Of all the business theories developing

at the time, Romney and his cohort were particularly influenced by one

that played to their sense of detachment from the business

Establishment. In 1976, two business scholars, Harvard’s Michael Jensen

and the University of Rochester’s William Meckling, published an

important paper elaborating a new idea of the firm, one that would come

to be called “agency theory.” Previous corporate theory had emphasized a

separation of powers between shareholders (who own a company) and

management (the executives who run it). This situation, Jensen and

Meckling pointed out, introduces a “principal-agent” problem, in which

each agent has incentives that run contrary to the shareholders’

interests and could hamper the firm’s ability to function.

If you were looking

across the landscape of American business 30 years ago, you could see

agency problems everywhere. In the sixties, companies had become

conglomerates so frequently that 20 percent of the Fortune 500 underwent

a merger or an acquisition in a three-year period. CEOs had enjoyed

building empires, and their shareholders, satisfied by decent returns,

had often deferred to management control. But during the stagnant

seventies, CEOs seemed loath to close factories and lay off workers. By

the early eighties, as growth once again seemed possible, shareholders

had become more restive, and innovative thinkers on Wall Street had

begun to press the case that these companies had grown inefficient and

timid, that management was underperforming.

Bain consultants did

what they could, during their assignments, to improve their clients’

operations, but they were often frustrated by an agent problem of their

own: Bain was just a consulting firm, and “a consulting firm,” says

David Dominik, an early Romney colleague, “can’t make anything happen.”

But Jensen and Meckling had sketched out one potential solution: If

managers could secure financing to run their own companies, they might

be able to build a better corporation, one that delivered stronger

returns to its owners.

You could view this

idea at least two different ways. One was as a chance to change the way

American business is run. Another was as a business opportunity to

exploit. Romney saw both.

Every

business story begins with a proposition, and the one that launched

Bain Capital was the notion that the partners might do better if they

stopped simply advising companies and starting buying and running the

firms themselves. When Bill Bain asked Romney to run the new spinoff, in

1983, the idea made sense from the perspective of Bain & Company.

The senior partners were awash in cash that they were looking to invest;

its more junior partners needed something to do. The original plan was

vague in the details, but a bowl was soon passed around the Bain &

Company boardroom so each partner could write his first name and the

amount he wanted to invest on a scrap of paper and slip it in. Romney’s

reputation was strong enough that he picked up $12 million in pledges in

that meeting alone.

Finding outside

investors wasn’t as easy. Romney went on the road, traveling to meet

with billionaire families—an investment arm of the Rockefeller fortune, a

Rothschild heir—arguing that Bain’s work in consultancy had prepared

them to turn businesses around themselves. But Romney and his cohort

were young men in their thirties with no experience investing money or

running companies, and for nearly a year the pitch kept failing. Romney

finally found some takers from Latin America, most important the

enormously wealthy Poma family, and by 1984, he and six consultants he’d

picked were staging a photo shoot for the brochure accompanying their

first fund; grinning and geeky, they posed for an outtake with dollar

bills stuffed in their mouths, their sleeves, their collars.

The leveraged-buyout

industry in its early days functioned as a laboratory for reinventing

business. Most of the promising firms were based in New York and

specialized in financial innovation—reengineering a balance sheet or

making use of new tools like junk bonds. Romney’s team in Boston looked

down on them as “just deal guys,” and at financial engineering as a

“commodity product.” Bain Capital focused instead on the way a business

runs.

Their new firm

reflected some aspects of Romney’s own personality: his mania for detail

and for process. He was a cautious executive. “Mitt was always worried

that things weren’t going to work out—he never took big risks,” one of

his colleagues told me. “Everything was very measurable. I think Mitt

had a tremendous amount of insecurity and fear of failure.” Romney never

worked from any particular “macro theme,” any philosophy of how the

economy was moving. What he employed instead was an exhausting habit of

playing devil’s advocate, proposing sequential objections to a

particular project or idea, until eventually, through a kind of

Darwinian process, consensus was reached. “I never viewed Mitt as very

decisive,” says one of his Bain Capital colleagues. “The idea was that

if there’s enough argument around an issue by bright people, ultimately

the data will prevail.” Romney may have been, as another early Bain

Capital partner puts it, a “very case-by-case, reactive thinker,” but he

was also an extremely hard worker and an egalitarian boss. He inspired

intense loyalty, and there are still members of his circle who describe

him as a perfect CEO. He was prone to profuse sweating, and the imagery

of the era is heavy on the CEO’s drenched, stained shirts.

|

Romney,

center, and six other founding members of Bain Capital, in an outtake

of their photo shoot for a 1984 brochure that surfaced this month.

|

In the mid-eighties, a

European retail outfit called Makro, a kind of continental Costco, was

looking for an executive to help run its U.S. business, and it called a

Boston supermarket executive named Tom Stemberg, inviting him to tour a

pilot store outside of Philadelphia. The store didn’t impress him much,

but he noticed that the office-supply aisle was absolutely packed with

shoppers. He told the Makro executives to abandon their model and

concentrate solely on office supplies; when they declined, he decided to

give it a try himself. Boston business is a small world, and when he

went looking for a venture-capital partner, he eventually found his way

to Mitt Romney and his new $37 million fund. “Most V.C.’s thought it

was ridiculous,” Stemberg says. “Mitt was highly unusual in that he went

to the research level to study it.”

The trouble with the

idea, to Romney’s subordinates at Bain Capital, was that the small

businesses Stemberg needed to draw weren’t accustomed to visiting a

store for office supplies; they got them from separate vendors, some who

delivered—one supplier for pens and paper, one for printer cartridges,

and so on. “Some of us were worried that we needed to change consumer

behavior,” recalls Robert F. White, one of the firm’s managing

directors. Romney persisted. As members of the group surveyed more and

more small businesses in suburban Massachusetts, they discovered that if

you asked a small-business manager how much he spent on office

supplies, he would give you a low estimate and tell you it wasn’t worth

it to send someone in a car to buy them. But if you asked the

bookkeepers, you got a far higher number, about five times as much—high

enough, Romney and Stemberg thought, to get them to come to the store.

The idea became Staples. Romney’s Bain Capital colleagues were soon

helping to select a cheaper, more efficient computer system for the

first store; they were helping stock the shelves themselves. As Staples

succeeded, and began to expand, they looked at analytics for

everything—the small-business population around a proposed store site,

traffic flow—and gamed out exactly how big a customer would need to be

before it demanded delivery. Romney sat on the Staples board for years,

and his company made nearly seven times what it invested in the

start-up.

“These

Bain Capital

guys were agents of the shareholder-value revolution.”

Romney

and his team did this sort of thing again and again, sometimes in

venture-capital deals but more often through buyouts—Brookstone,

Domino’s, Sealy, Duane Reade. In their more complex deals, they couldn’t

rely on their own team to seek out every inefficiency. They needed a

more powerful lever, and they turned to the solution Jensen and Meckling

had begun to explore a decade earlier: offering CEOs large equity

stakes in the company in the form of stock or stock options. This was a

relatively new idea, mostly untried in American business. At the same

time, a board formed in part of Bain Capital appointees who had put up

their own money in the deal would be more engaged in management details.

“You have the total alignment of incentives of ownership, board, and

management—everyone’s incentives are aligned around building shareholder

value,” Dominik says. “It really is that simple.”

In 1986, Bain Capital

bought a struggling division of Firestone that made truck wheels and

rims and renamed it Accuride. Bain took a group of managers whose

previous average income had been below $100,000 and gave them

performance incentives. This type and degree of management compensation

was also unusual, but here it led to startling results: According to an

account written by a Bain & Company fellow, the managers quickly

helped to reorganize two plants, consolidating operations—which meant,

inevitably, the shedding of unproductive labor—and when the company grew

in efficiency, these managers made $18 million in shared earnings. The

equation was simple: The men who increased the worth of the corporation

deserved a bigger and bigger percentage of its spoils. In less than two

years, when Bain Capital sold the company, it had turned an initial $5

million investment into a $121 million return.

Even by the standards

of the times, Bain Capital grew tremendously fast: from $37 million

under management in 1984 to $500 million in 1994 (and $65 billion

today). To other businesses, the buyout industry both presented a model

for better profits and posed a take-over threat. “Having the

private-equity guys out there disciplined other companies,” says Nick

Bloom, a Stanford economist. Some techniques developed in the buyout

laboratory spread. Productive workers and managers were rewarded, while

unproductive ones were cut loose. Corporations realigned themselves to

deliver more value to their shareholders, increasing dividend payments

and stock buybacks. Within a decade, ordinary businesses were giving

large stock and option packages to CEOs. Executive compensation soared.

“These Bain Capital guys,” says Neil Fligstein, an economics-sociology

professor at the University of California, Berkeley, “were agents of the

shareholder value revolution.” By the mid-nineties,

The Business Roundtable

had changed its definition of the role of a company, winnowing a broad

set of responsibilities down to a single one: increasing shareholder

value.

In

October 1994, a machine operator named Harold Kellogg gathered five of

his colleagues; borrowed a brown van from a used-car dealership in

Marion, Indiana; and began to drive east on I-90, headed for Boston,

where Romney, in his first political race, had suddenly begun to

threaten Ted Kennedy. Kellogg had worked, for eleven years, for an

office-supplies manufacturer called SCM, but a few months earlier his

plant had been acquired by a Texas-based company called American Pad and

Paper, in which Bain Capital had a majority stake. AmPad fired all of

the union workers at Kellogg’s plant, more than 250 people in total,

then hired most of them back at much lower wages; for years, they had

gotten health-care coverage as part of their pay package, but now AmPad

asked them to pay half of the costs. The whole plant walked out.

The narrative that the

Kennedy campaign had been trying to build through the summer was that

Romney was a Gordon Gekko type, but it didn’t really catch until

Kellogg and his five friends started touring Massachusetts, visiting

manufacturing plants, and then confronted Romney during an appearance at

an East Boston Columbus Day parade. Kennedy’s campaign commercials were

suddenly filled with flat midwestern accents. Romney promised, tepidly,

to meet with the Indianans, “to see if there’s anything I can do.”

Kennedy held on, and the line among political consultants was that the

Kellogg stunt had helped turn the election.

It didn’t do much to

help Kellogg. The plant in Marion closed down six months later, and the

machine operator went to work at a nearby glass company. Management sent

in Pinkerton guards and, according to a union source, took away

machinery and moved it to nonunion plants in Utah and Massachusetts.

“You had an industry where the only thing they did was converting paper

to make Siegel pads, notebooks, and copy paper,” says Marc Wolpow, who

was at the time the Bain Capital partner who worked on the AmPad deal.

Labor in the plants, he says, was nearly a commodity product—the only

thing Kellogg and his co-workers did was to move paper from one machine

to another. This could be done more cheaply at plants in China or

Indonesia. “Those jobs were going to get destroyed internationally. That

plant was going to go out of business, and there was nothing Mitt

should have done, or could have done, to prevent it.” But it is harder

to be so charitable when you look at the broader moral contours of the

arrangement. By 2001, five years after the company had been taken

public, it had filed for bankruptcy and liquidated its assets. But Bain

Capital made more than $100 million from AmPad for itself and its

investors.

After the plant

closed, the head of its union, Randy Johnson, tried to keep track of

where everyone went. He assembled a roster of the destinations of his

former colleagues—some moved to Tennessee, some to Texas—but the effort

was incomplete, and what Johnson compiled was only a partial catalogue

of loss. It’s difficult to track the fallout of any one private-equity

firm’s work, but scholars have been able to look at the conesquences of

the industry as a whole. These studies have consistently found that

private-equity takeovers improve productivity and shed jobs. But one

interesting nineties study, by two academics, Don Siegel at SUNY Stony

Brook and Frank Lichtenberg at Columbia, found something surprising:

White-collar workers, for the first time, were more vulnerable than

blue-collar workers. “Part of what the private-equity firms were doing

was replacing office workers with information technology—that’s where

they were getting some of their gains,” says Siegel, now the dean of the

University of Albany’s business school.

Here, too, private

equity seemed to provide an early warning of broader changes. In three

years during the early nineties, the Princeton economist Henry Farber

has found, roughly 10 percent of American white-collar male managers

lost their jobs. For the first time, according to data collected through

the General Social Survey, white-collar workers were nearly as worried

about losing their jobs as blue-collar workers. Those white-collar

workers who kept their jobs worked harder, and the compensation that had

once been spread through the broader middle ranks of corporations now

collected at the top. In 1980, a CEO had earned about 35 times the wages

of an average worker; by 1990, it was about 80; and by 2000, it was

about 300. The portion of America’s gross national product that ended up

in the hands of workers declined by more than 10 percent between 1979

and 1996; the portion that went to investors rose by a similar amount.

“What you end up with is a choice between a bigger cake less equally

split and a smaller cake equally split,” says Bloom, the Stanford

economist. “But that’s a social question.”

There

is no doubt that the tools of this efficiency movement helped to build

the economy of the nineties, and this fact makes Bloom’s social question

somewhat more complicated. That booming decade, with unemployment

declining by 3.5 percent and real GDP growing by nearly 4 percent each

year during the Clinton administration, depended heavily on a spike in

productivity, which itself had hinged on the wide deployment of computer

technology to displace more expensive forms of labor. Economists

believe there was a clear connection between the labor-market changes in

the early nineties and the great profits that soon followed. “Could we

have had the productivity boom without displacement? My answer would be

no,” says Frank Levy, an MIT economist.

The trouble, Levy

believes, was that this new shareholder-value-driven system had no

built-in mechanism of regulation, and its incentives geared CEOs toward

shortsightedness and recklessness. “Any profit-making organization was

going to take advantage of the opportunities to lower costs and become

more efficient by taking advantage of foreign producers and installing

technology, both of which meant losing jobs,” he says. “But

decision-makers fully exploited at every turn the market power that they

had. The question is, why were we so willing to exploit everything?”

The obvious answer is

financial reward. But there may have been a cultural component, too. By

the time Mitt Romney left Bain Capital for good, in 1999, American CEOs

looked very different from the predecessors he had met in the

seventies—the genial paternalists, spending their careers at a single

company. More and more, they were pure meritocrats—well-educated,

well-compensated, moving frequently between jobs and industries, trained

to look ruthlessly for efficiency everywhere. They look a great deal

more, in other words, like Mitt Romney.

If you trace the

public controversies over Bain Capital over time, you can see how the

obsession over shareholder value and efficiency proved not just

inequitable but destabilizing. A half-decade after Harold Kellogg

showed up in Boston, Bain Capital and others were sued by shareholders

of Stage Stores, a Texas retailer, charging Bain of helping to

manipulate the stock. The lawsuit accused the company of giving

misleadingly optimistic performance projections, which sent the

retailer’s stock soaring past $50 a share, at which point Bain Capital

unloaded virtually all of its stock. When more realistic earnings

projections were released, Stage Store’s stock plunged 58 percent in a

single day. The lawsuit was later dismissed. But then, shortly after

Romney left came the KB Toys fiasco, in which, another lawsuit alleged,

Bain Capital and KB executives took a dividend recap of over $120

million two years before the company collapsed into bankruptcy.

No court found that

Bain Capital did anything illegal in these cases. But these episodes

still give a glimpse of the evolving problems of the shareholder-value

model, and some consequences of the trade-off we made of stability for

growth. In some economic moments, a program of radical efficiency can be

good for society; at other times, when there is less fat to trim, the

same instincts can lead a company to cannibalize itself. “We’re living

in a crueler capitalism,” Fligstein says. By some measures, he adds,

“we’ve gone really quite a long ways. And nobody really knows what the

tipping point is, or how you go back.”

When

Romney was elected governor of Massachusetts in 2002, one of the

members of his transition team was Tom Stemberg, the founder of Staples.

The two men were talking one day, and Romney asked Stemberg if he had

any ideas for how he ought to govern. Stemberg, thinking off the top of

his head, had two ideas. “One was to blow up Logan airport and start

over.” That didn’t make it far. The other one did.

Stemberg served then

(as now) on the president’s council of Massachusetts General Hospital,

and he remembered a conversation he’d had with a doctor named Peter

Slavin, who has been the chief executive of that hospital system for

most of the last decade. “[Slavin] mentioned this huge problem,”

Stemberg told me, “which is all these uninsured people clog the ER.” The

hospital had to treat them. “There was a law that said that all the

insurance companies had to fund the free care. That system made

absolutely no sense. “It was, as Stemberg told Romney, “the least

efficient way to serve them.” The conversation moved on, and Stemberg

figured his ten-minute-long career as a policy maven was over. “I

figured that’s the end of that.” But Romney’s staffers, consulting with

experts, began to work out a fix, requiring almost every citizen in the

state to carry insurance, and providing subsidies for those who couldn’t

afford it. Eventually he was heading down to Ted Kennedy’s office in

Washington to explain the program, PowerPoints in hand. Three and a

half years later, Romney introduced his universal-health-care plan, and

in the press he credited Stemberg with suggesting it.

The

punch line, of course—the punch line to Romney’s campaign so far—is

that the plan he built was an almost exact model for Obama’s national

plan, designed by some of the same experts.

But what separates

Romney’s plan from Obama’s—and gives some clues about his potential

presidency—is its almost-accidental origin. Romney did not begin with a

philosophical quest to improve American health care. He began with the

idea of himself as a problem solver and asked those around him for a

problem that he might usefully solve. I remembered, when I was told this

story, an anecdote I’d heard from a former political staffer of

Romney’s. On even basic philosophical questions like abortion, the

staffer said, Romney did not try to resolve the question in the

abstract, as a matter of principle, and would consider instead various

hypothetical cases—for instance, a late-term abortion—and build from

them a politics. The line that Romney is a flip-flopper may vastly

understate the depth of the condition.

It is arresting to

imagine a Romney White House, inevitably filled with as many former Bain

colleagues as each of his other public ventures have been: The

PowerPoints, the 80-20 jargon, the clinical separation of

decision-making from ideology, the detachment of those decisions from

moral consequence, a persistent blind spot for people as people. It

would represent the final ascension of a perfectly American type, one

that has already remade the culture of business. I once asked a Bain

colleague of Romney’s how Romney thought of his own core competence. “I

think Mitt thinks he’s good at being Mitt Romney,” the colleague said.

But Romney’s

career-long commitment to his own particular brand of impersonal

decision-making might suggest something personal after all. One great

mystery about Romney has been where his Mormonism comes in and what it

explains. Maybe the clearest answer comes from taking at their word the

businessmen with whom he came up, who say they never saw its influence.

Romney’s religion constitutes a minority set of beliefs. Poorly

understood and widely mocked, it can provoke suspicions about his

motives. Perhaps it is not surprising, then, that he has adopted a

public persona that contains no detectable motives at all, one that is

buried in objectivity, in data, in process. The best evidence of how

important Romney’s religion is to him could be how far he has kept it

from view. But the character that remains visible is at once uniquely

American and a little strange: a perfectly objective efficiency machine.

No comments:

Post a Comment