Adapted from The Real Romney,

by Michael Kranish and Scott Helman, to be published this month by HarperCollins; © 2012 by The Boston Globe

.

Mitt

Romney’s privileged pedigree was common knowledge to his classmates at

Harvard Business School and Harvard Law School, where he was

simultaneously enrolled in 1971 through a joint-degree program. By that

time, his father, George Romney, had run a major corporation (American

Motors), been elected three times as Michigan’s governor, sought the

presidency, and been appointed to President Nixon’s Cabinet. Despite

strongly resembling the elder Romney—the full head of strikingly dark

hair, square jaw, dazzling smile—Mitt did little to draw attention to

his parentage. The only hint was George’s faded gold initials on a

beat-up old briefcase that Mitt carried around.

In truth, Mitt

cherished his father’s example and endeavored to follow it. George

became more than just a mentor to his youngest son. He was a pathfinder,

showing the way of their Mormon faith through the thickets of politics

and business, home life, and character. Through his achievements and

mistakes, George had bestowed many lessons, and Mitt soaked them up.

“His whole life,” said John Wright, a close family friend, “was

following a pattern which had been laid out by his dad.” So with his

wife, Ann, as a partner and his father as an inspiration, Mitt set out

to build a family, a career, and a place in the church that he loved.

The

Romneys’ Mormon faith, as Mitt and Ann began their life together,

formed a deep foundation. It lay under nearly everything—their acts of

charity, their marriage, their parenting, their social lives, even their

weekly schedules. Their family-centric lifestyle was a choice; Mitt and

Ann plainly cherished time at home with their children more than

anything. But it was also a duty. Belonging to the Mormon Church meant

accepting a code of conduct that placed supreme value on strong

families—strong heterosexual families, in which men and women often

filled defined and traditional roles. The Romneys have long cited a

well-known Mormon credo popularized by the late church leader David O.

McKay: “No other success can compensate for failure in the home.” They

had arrived in the Boston area with one son, Taggart, and soon had a

second, Matthew. Over the next decade, the Romneys would have three more

boys: Joshua was born in 1975, Benjamin in 1978, and then Craig in

1981.

To Mitt, the special one in the

house was Ann, with her wide smile, piercing eyes, and steadying

domestic presence. And woe was the boy who forgot it. Tagg said there

was one rule that was simply not breakable: “We were not allowed to say

anything negative about my mother, talk back to her, do anything that

would not be respectful of her.” On Mother’s Day, their home would be

fragrant with lilacs, Ann’s favorite flowers. Tagg didn’t get it back

then, but he came to understand. From the beginning, Mitt had put Ann on

a pedestal and kept her there. “When they were dating,” Tagg said, “he

felt like she was way better than him and he was really lucky to have

this catch. He really genuinely still feels that way.” What makes his

parents’ relationship work, he said, is their distinct characters: Mitt

is driven first by reason, while Ann operates more on emotion. “She

helps him see there’s stuff beyond the logic; he helps her see that

there’s more than just instinct and feeling,” Tagg said. Mitt and Ann’s

relationship would grow and change as their family entered the public

eye. But she has remained his chief counselor and confidante, the one

person who can lead Mitt to a final decision. Though she did not

necessarily offer detailed input on every business deal, friends said,

she weighed in on just about everything else. “Mitt’s not going to do

something that they don’t feel good about together,” said Mitt’s sister

Jane. Tagg said they called their mom “the great Mitt stabilizer.” Ann

would later be mocked for her claim that she and Mitt had never had an

argument during their marriage, which sounded preposterous to the ears

of many married mortals. Tagg said it’s not that his parents never

disagree. “I know there are things that she says that he doesn’t agree

with sometimes, and I see him kind of bite his tongue. But I know that

they go and discuss it in private. He doesn’t ever contradict my mother

in public.” Friends of the Romneys’ back up that account, saying they

cannot recall Mitt ever raising his voice toward Ann. Nowhere was Ann’s

special status more evident than on long family car trips. Mitt imposed

strict rules: they would stop only for gas, and that was the only chance

to get food or use the restroom. With one exception, Tagg explained.

“As soon as my mom says, ‘I think I need to go to the bathroom,’ he

pulls over instantly and doesn’t complain. ‘Anything for you, Ann.’” On

one infamous road trip, though, it wasn’t Ann who forced Mitt off the

highway. The destination of this journey, in the summer of 1983, was his

parents’ cottage, on the Canadian shores of Lake Huron. The white Chevy

station wagon with the wood paneling was overstuffed with suitcases,

supplies, and sons when Mitt climbed behind the wheel to begin the

12-hour family trek from Boston to Ontario. As with most ventures in his

life, he had left little to chance, mapping out the route and planning

each stop. Before beginning the drive, Mitt put Seamus, the family’s

hulking Irish setter, in a dog carrier and attached it to the station

wagon’s roof rack. He had improvised a windshield for the carrier to

make the ride more comfortable for the dog.

Then Mitt put his

sons on notice: there would be pre-determined stops for gas, and that

was it. Tagg was commandeering the way-back of the wagon, keeping his

eyes fixed out the rear window, when he glimpsed the first sign of

trouble. “Dad!” he yelled. “Gross!” A brown liquid was dripping down the

rear window, payback from an Irish setter who’d been riding on the roof

in the wind for hours. As the rest of the boys joined in the howls of

disgust, Mitt coolly pulled off the highway and into a service station.

There he borrowed a hose, washed down Seamus and the car, then hopped

back onto the road with the dog still on the roof. It was a preview of a

trait he would grow famous for in business: emotion-free crisis

management. But the story would trail him years later on the national

political stage, where the name Seamus would become shorthand for

Romney’s coldly clinical approach to problem solving.

The Book of Mitt

If

Romney is exceedingly comfortable around family and close friends, he’s

much less so around those he doesn’t know well, drawing a boundary

that’s difficult to traverse. It’s a strict social order—us and

them—that has put co-workers, political aides, casual acquaintances, and

others in his professional circles, even people who have worked with or

known him for years, outside the bubble. As a result, he has numerous

admirers but, by several accounts, not a long list of close pals. “He’s

very engaging and charming in a small group of friends he’s comfortable

with,” said one former aide. “When he’s with people he doesn’t know, he

gets more formal. And if it’s a political thing where he doesn’t know

anybody, he has a mask.” For those outside the inner circle, Romney

comes across as all business. Colleagues at work or political staffers

are there to do a job, not to bond. “Mitt is always the star,” said one

Massachusetts Republican. “And everybody else is a bit player.” He has

little patience for idle chatter or small talk, little interest in

mingling at cocktail parties, at social functions, or even in the

crowded hallway. He is not fed by, and does not crave, casual social

interaction, often displaying little desire to know who people are and

what makes them tick. “He wasn’t overly interested in people’s personal

details or their kids or spouses or team building or their career path,”

said another former aide. “It was all very friendly but not very deep.”

Or, as one fellow Republican put it, “He has that invisible wall

between ‘me’ and ‘you.’” Referring to the time later when Romney was

governor of Massachusetts, a Democratic lawmaker recalls, “You remember

Richard Nixon and the imperial presidency? Well, this was the imperial

governor.” There were the ropes that often curtailed access to Romney

and his chambers. The elevator settings restricted access to his office.

The tape on the floor told people exactly where to stand during events.

This was the controlled environment that Romney created. His orbit was

his own. “We always would talk about how, among the legislators, he had

no idea what our names were—none,” the lawmaker said, “because he was so

far removed from the day-to-day operations of state government.”

This

sense of detachment is a function partly of his faith, which has its

own tight social community that most outsiders don’t see. Indeed, the

stories of Romney’s humanity and warmth come mostly from people who know

him as a fellow Mormon. His abstention from drinking also makes parties

and other alcohol-fueled functions distinctly less appealing. He is the

antithesis of the gregarious pol with a highball in one hand and a

cigar in his mouth. Romney’s discomfort around strangers would later

become more than just a curiosity; it would be an impediment on the

campaign trail. Lacking an easy rapport with voters, he would come

across as aloof, even off-putting. “A lot of it is he is patrician. He

just is. He has lived a charmed life,” said one former aide. “It is a

big challenge that he has, connecting to folks who haven’t swum in the

same rarefied waters that he has.” His growing wealth, the deeper he got

into his career, only widened the disconnect. Even as he began

shouldering more responsibility at work, Romney would assume several

leadership positions in the Mormon Church. But he could handle it.

“Mitt,” said Kem Gardner, a fellow church official from this period,

“just had the capacity to keep all the balls up in the air.” Or, as Tagg

put it, “Compared to my dad, everyone’s lazy.” Helen Claire Sievers,

who served in a church leadership position under Romney, got a glimpse

of his work habits during weekend bus trips to the Mormon temple near

Washington, D.C. Church groups would leave late on a Friday, drive all

night, and arrive early on Saturday morning. Then they’d spend all day

Saturday in temple sessions before turning around and driving home, to

be back by Sunday morning. It was a grueling itinerary, Sievers said, so

everyone used the time on the bus to sleep or read quietly. Everyone

but Romney. “Mitt was always working. His light was on,” she said.

Mormon

congregations, typically groups of 400 to 500 people, are known as

wards, and their boundaries are determined by geography. Wards, along

with smaller congregations known as branches, are organized into stakes.

Thus a stake, akin to a Catholic diocese, is a collection of wards and

branches in a city or region. Unlike Protestants or Catholics, Mormons

do not choose the congregations to which they belong. It depends

entirely on where they live. In another departure from many other

faiths, Mormons do not have paid full-time clergy. Members in good

standing take turns serving in leadership roles. They are expected to

perform their ecclesiastical duties on top of career and family

responsibilities. Those called to serve as stake presidents and bishops,

or leaders of local wards, are fully empowered as agents of the church,

and they carry great authority over their domains. Mitt Romney first

took on a major church role around 1977, when he was called to be a

counselor to Gordon Williams, then the president of the Boston stake.

Romney was essentially an adviser and deputy to Williams, helping

oversee area congregations. His appointment was somewhat unusual in that

counselors at that level have typically been bishops of their local

wards first. But Romney, who was only about 30 years old, was deemed to

possess leadership qualities beyond his years. Romney’s responsibilities

only grew from there; he would go on to serve as bishop and then as

stake president, overseeing about a dozen congregations with close to

4,000 members altogether. Those positions in the church amounted to his

biggest leadership test yet, exposing him to personal and institutional

crises, human tragedies, immigrant cultures, social forces, and

organizational challenges that he had never before encountered.

The

Church of Jesus Christ of Latter-Day Saints is far more than a form of

Sunday worship. It is a code of ethics that frowns on homosexuality,

out-of-wedlock births, and abortion and forbids pre-marital sex. It

offers a robust, effective social safety net, capable of incredible

feats of charity, support, and service, particularly when its own

members are in trouble. And it works hard to create community, a

built-in network of friends who often share values and a worldview. For

many Mormons, the all-encompassing nature of their faith, as an

extension of their spiritual lives, is what makes belonging to the

church so wonderful, so warm, even as its insularity can set members

apart from society.

But a dichotomy exists within the Mormon

Church, which holds that one is either in or out; there is little or no

tolerance for those, like so-called cafeteria Catholics, who pick and

choose what doctrines to follow. And in Mormonism, if one is in, a lot

is expected, including tithing 10 percent of one’s income, participating

regularly in church activities, meeting high moral expectations, and

accepting Mormon doctrine—including many concepts, such as the belief

that Jesus will rule from Missouri in his Second Coming, that run

counter to those of other Christian faiths. That rigidity can be

difficult to abide for those who love the faith but chafe at its

strictures or question its teachings and cultural habits. For one,

Mormonism is male-dominated—women can serve only in certain leadership

roles and never as bishops or stake presidents. The church also makes a

number of firm value judgments, typically prohibiting single or divorced

men from leading wards and stakes, for example, and not looking kindly

upon single parenthood.

The portrait of Romney that emerges from

those he led and served with in the church is of a leader who was pulled

between Mormonism’s conservative core views and practices and the

demands from some quarters within the Boston stake for a more elastic,

more open-minded application of church doctrine. Romney was forced to

strike a balance between those local expectations and the dictates out

of Salt Lake City. Some believe that he artfully reconciled the two,

praising him as an innovative and generous leader who was willing to

make accommodations, such as giving women expanded responsibility, and

who was always there for church members in times of need. To others, he

was the product of a hidebound, patriarchal Mormon culture, inflexible

and insensitive in delicate situations and dismissive of those who

didn’t share his perspective.

In the

spring of 1993, Helen Claire Sievers performed a bit of shuttle

diplomacy to resolve a thorny problem confronting church leaders in

Boston: resentment among progressive Mormon women at their subservient

status within the church. Sievers was active in an organization of

liberal women called Exponent II, which published a periodical. The

group had been chewing over the challenges of being a woman in the

male-led faith. So Sievers went to Romney, who was stake president, with

a proposal. “I said, ‘Why don’t you have a meeting and have an open

forum and let women talk to you?’” she recalled. The idea was that,

although there were many church rules that stake presidents and bishops

could not change, they did have some leeway to do things their own way.

Romney

wasn’t sure about holding such a meeting, but he ultimately agreed to

it. Sievers went back to the Exponent II group and said they should be

realistic and not demand things Romney could never deliver, such as

allowing women to hold the priesthood. On the day of the meeting, about

250 women filled the pews of the Belmont Chapel. After an opening song,

prayer, and some housekeeping items, the floor was open. Women began

proposing changes that would include them more in the life of the

church. In the end, the group came up with some 70 suggestions—from

letting women speak after men in church to putting changing tables in

men’s bathrooms—as Romney and one of his counselors listened and took

careful notes.

Romney was essentially willing to grant any

request he couldn’t see a reason to reject. “Pretty much, he said yes to

everything that I would have said yes to, and I’m kind of a liberal

Mormon,” Sievers said. “I was pretty impressed.” (Ann Romney was not

considered to be sympathetic to the agitation of liberal women within

the stake. She was invited to social events sponsored by Exponent II but

did not attend. She was, in the words of one member, understood to be

“not that kind of woman.”)

Romney’s leadership was not so rosy

for everyone, though. As both bishop and stake president, he at times

clashed with women he felt strayed too far from church beliefs and

practice. To them, he lacked the empathy and courage that they had known

in other leaders, putting the church first even at times of great

personal vulnerability. Peggie Hayes had joined the church as a teenager

along with her mother and siblings. They’d had a difficult life.

Mormonism offered the serenity and stability her mother craved. “It

was,” Hayes said, “the answer to everything.” Her family, though poorer

than many of the well-off members, felt accepted within the faith.

Everyone was so nice. The church provided emotional and, at times,

financial support. As a teenager, Hayes babysat for Mitt and Ann Romney

and other couples in the ward. Then Hayes’s mother abruptly moved the

family to Salt Lake City for Hayes’s senior year of high school.

Restless and unhappy, Hayes moved to Los Angeles once she turned 18. She

got married, had a daughter, and then got divorced shortly after. But

she remained part of the church.

By

1983, Hayes was 23 and back in the Boston area, raising a 3-year-old

daughter on her own and working as a nurse’s aide. Then she got pregnant

again. Single motherhood was no picnic, but Hayes said she had wanted a

second child and wasn’t upset at the news. “I kind of felt like I could

do it,” she said. “And I wanted to.” By that point Mitt Romney, the man

whose kids Hayes used to watch, was, as bishop of her ward, her church

leader. But it didn’t feel so formal at first. She earned some money

while she was pregnant organizing the Romneys’ basement. The Romneys

also arranged for her to do odd jobs for other church members, who knew

she needed the cash. “Mitt was really good to us. He did a lot for us,”

Hayes said. Then Romney called Hayes one winter day and said he wanted

to come over and talk. He arrived at her apartment in Somerville, a

dense, largely working-class city just north of Boston. They chitchatted

for a few minutes. Then Romney said something about the church’s

adoption agency. Hayes initially thought she must have misunderstood.

But Romney’s intent became apparent: he was urging her to give up her

soon-to-be-born son for adoption, saying that was what the church

wanted. Indeed, the church encourages adoption in cases where “a

successful marriage is unlikely.”

Hayes was deeply insulted. She

told him she would never surrender her child. Sure, her life wasn’t

exactly the picture of Rockwellian harmony, but she felt she was on a

path to stability. In that moment, she also felt intimidated. Here was

Romney, who held great power as her church leader and was the head of a

wealthy, prominent Belmont family, sitting in her gritty apartment

making grave demands. “And then he says, ‘Well, this is what the church

wants you to do, and if you don’t, then you could be excommunicated for

failing to follow the leadership of the church,’ ” Hayes recalled. It

was a serious threat. At that point Hayes still valued her place within

the Mormon Church. “This is not playing around,” she said. “This is not

like ‘You don’t get to take Communion.’ This is like ‘You will not be

saved. You will never see the face of God.’ ” Romney would later deny

that he had threatened Hayes with excommunication, but Hayes said his

message was crystal clear: “Give up your son or give up your God.”

Not

long after, Hayes gave birth to a son. She named him Dane. At nine

months old, Dane needed serious, and risky, surgery. The bones in his

head were fused together, restricting the growth of his brain, and would

need to be separated. Hayes was scared. She sought emotional and

spiritual support from the church once again. Looking past their

uncomfortable conversation before Dane’s birth, she called Romney and

asked him to come to the hospital to confer a blessing on her baby.

Hayes was expecting him. Instead, two people she didn’t know showed up.

She was crushed. “I needed him,” she said. “It was very significant that

he didn’t come.” Sitting there in the hospital, Hayes decided she was

finished with the Mormon Church. The decision was easy, yet she made it

with a heavy heart. To this day, she remains grateful to Romney and

others in the church for all they did for her family. But she shudders

at what they were asking her to do in return, especially when she pulls

out pictures of Dane, now a 27-year-old electrician in Salt Lake City.

“There’s my baby,” she said.

In the fall

of 1990, Exponent II published in its journal an unsigned essay by a

married woman who, having already borne five children, had found herself

some years earlier facing an unplanned sixth pregnancy. She couldn’t

bear the thought of another child and was contemplating abortion. But

the Mormon Church makes few exceptions to permit women to end a

pregnancy. Church leaders have said that abortion can be justified in

cases of rape or incest, when the health of the mother is seriously

threatened, or when the fetus will surely not survive beyond birth. And

even those circumstances “do not automatically justify an abortion,”

according to church policy.

Then the woman’s doctors discovered

she had a serious blood clot in her pelvis. She thought initially that

would be her way out—of course she would have to get an abortion. But

the doctors, she said, ultimately told her that, with some risk to her

life, she might be able to deliver a full-term baby, whose chance of

survival they put at 50 percent. One day in the hospital, her

bishop—later identified as Romney, though she did not name him in the

piece—paid her a visit. He told her about his nephew who had Down

syndrome and what a blessing it had turned out to be for their family.

“As your bishop,” she said he told her, “my concern is with the child.”

The woman wrote, “Here I—a baptized, endowed, dedicated worker, and

tithe-payer in the church—lay helpless, hurt, and frightened, trying to

maintain my psychological equilibrium, and his concern was for the

eight-week possibility in my uterus—not for me!”

Romney would

later contend that he couldn’t recall the incident, saying, “I don’t

have any memory of what she is referring to, although I certainly can’t

say it could not have been me.” Romney acknowledged having counseled

Mormon women not to have abortions except in exceptional cases, in

accordance with church rules. The woman told Romney, she wrote, that her

stake president, a doctor, had already told her, “Of course, you should

have this abortion and then recover from the blood clot and take care

of the healthy children you already have.” Romney, she said, fired back,

“I don’t believe you. He wouldn’t say that. I’m going to call him.” And

then he left. The woman said that she went on to have the abortion and

never regretted it. “What I do feel bad about,” she wrote, “is that at a

time when I would have appreciated nurturing and support from spiritual

leaders and friends, I got judgment, criticism, prejudicial advice, and

rejection.”

One woman who had been

active in the Exponent II organization was Judy Dushku, a longtime

scholar of global politics at Suffolk University in Boston. At one point

while Romney was stake president, Dushku wanted to visit the temple

outside Washington to take out endowments, a sacred rite that commits

Mormons to a lifetime of faithfulness to the church. She had never

entered a temple before and was thrilled at the chance to affirm her

dedication to a faith she’d grown up with and grown to love. Earlier in

her life, temples had been off limits to Mormons who, like Dushku, were

married to non-Mormons. Now that rule had changed, and she was eager to

go. But first she needed permission from her bishop and stake president.

After

what she described as a “lovely interview” with her bishop and after

speaking with one of Romney’s counselors, she went to see Romney. She

wasn’t sure what to expect. Despite Romney’s willingness to allow some

changes in 1993, he and Dushku had clashed over the church’s treatment

of women. “He says something like ‘I suspect, if you’ve gotten through

both of the interviews, there’s nothing I can do to keep you from going

to the temple,’ ” Dushku recalled. “I said, ‘Well, why would you want to

keep me from going to the temple?’ ” Romney’s answer, Dushku said, was

biting. “He said, ‘Well, Judy, I just don’t understand why you stay in

the church.’ ” She asked him whether he wanted her to really answer that

question. “And he said, ‘No, actually. I don’t understand it, but I

also don’t care. I don’t care why you do. But I can tell you one thing:

you’re not my kind of Mormon.’ ” With that, Dushku said, he dismissively

signed her recommendation to visit the temple and let her go. Dushku

was deeply hurt. Though she and Romney had had their differences, he was

still her spiritual leader. She had hoped he would be excited at her

yearning to visit the temple. “I’m coming to you as a member of the

church, essentially expecting you to say, ‘I’m happy for you,’ ” Dushku

said. Instead, “I just felt kicked in the stomach.”

The Bain of Mitt’s Campaign

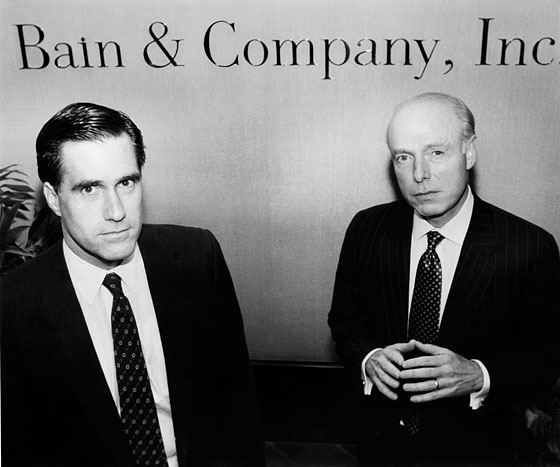

By

the time Mitt Romney walked into the Faneuil Hall offices of his mentor

and boss, Bill Bain, in the spring of 1983, the 36-year-old was already

a business-consulting star, coveted by clients for his analytical cool.

He was, as people had said of him since childhood, mature beyond his

years and organized to a fault. Everything he took on was thought

through in advance, down to the smallest detail; he was rarely taken by

surprise. This day, however, would be an exception. Bill Bain, the

founder of Bain & Company, one of the nation’s premier consulting

outfits, had a stunning proposition: he was prepared to entrust an

entirely new venture to the striking young man seated before him.

From

the moment they’d first met, Bill Bain had seen something special,

something he knew, in Mitt Romney. Indeed, he had seen someone he knew

when he interviewed Romney for a job in 1977: Mitt’s father. “I remember

[George] as president of American Motors when he was fighting the gas

guzzlers and making funny ads So when I saw Mitt, I instantly saw George

Romney. He doesn’t look exactly like his dad did, but he very strongly

resembles his father.” Beyond appearances, Mitt had an air of great

promise about him. He seemed brilliant but not cocky. All of the

partners were impressed, and some were jealous. More than one partner

told Bain, “This guy is going to be president of the United States

someday.”

The Bain Way, as it became known, was intensely

analytical and data-driven, a quality it shared with some other firms’

methods. But Bill Bain had come up with the idea of working for just one

client per industry and devoting Bain & Company entirely to that

company, with a strict vow of confidentiality. From the start Romney was

perfectly adapted to the Bain Way and became a devoted disciple.

Patient analysis and attention to nuance were what drove him. For six

years, he delved into numerous unfamiliar companies, learned what made

them work, scoped out the competition, and then presented his findings.

An increasing number of clients preferred Romney over more senior

partners. He was plainly a star, and Bain treated him as a kind of

prince regent at the firm, a favored son. Just the man for the big move

he now had in mind.

And so Bain made his pitch: Up to that point,

Bain & Company could watch its clients prosper only from a

distance, taking handsome fees but not directly sharing in profits.

Bain’s epiphany was that he would create a new enterprise that would

invest in companies and share in their growth, rather than just advise

them.

Starting almost immediately, Bain

proposed, Romney would become the head of a new company to be called

Bain Capital. With seed money from Bill Bain and other partners at the

consulting firm, Bain Capital would raise tens of millions of dollars,

invest in start-ups and troubled businesses, apply Bain’s brand of

management advice, and then resell the revitalized companies or sell

their shares to the public at a profit. It sounded exciting, daring,

new. It would be Romney’s first chance to run his own firm and,

potentially, to make a killing. It was an offer few young men in a hurry

could refuse.

Yet Romney stunned his boss by doing just that. He

explained to Bain that he didn’t want to risk his position, earnings,

and reputation on an experiment. He found the offer appealing but didn’t

want to make the decision in a “light or flippant manner.” So Bain

sweetened the pot. He guaranteed that if the experiment failed Romney

would get his old job and salary back, plus any raises he would have

earned during his absence. Still, Romney worried about the impact on his

reputation if he proved unable to do the job. Again the pot was

sweetened. Bain promised that, if necessary, he would craft a cover

story saying that Romney’s return to Bain & Company was needed due

to his value as a consultant. “So,” Bain explained, “there was no

professional or financial risk.” This time Romney said yes.

Thus

began Romney’s 15-year odyssey at Bain Capital. Boasting about those

years when running for senator, governor, or president, Romney would

usually talk about how he had helped create jobs at new or

underperforming companies, and would claim that he had learned how jobs

and businesses come and go. He’d typically mention a few well-known

companies in which he and his partners had invested, such as Staples.

But the full story of his years at Bain Capital is far more complicated

and has rarely been closely scrutinized. Romney was involved in about a

hundred deals, many of which have received little notice because the

companies involved were privately held and not household names. The most

thorough analysis of Romney’s performance comes from a private

solicitation for investment in Bain Capital’s funds written by the Wall

Street firm Deutsche Bank. The company examined 68 major deals that had

taken place on Romney’s watch. Of those, Bain had lost money or broken

even on 33. Overall, though, the numbers were stunning: Bain was nearly

doubling its investors’ money annually, giving it one of the best track

records in the business.

Romney was, by

nature, deeply risk-averse in a business based on risk. He worried about

losing the money of his partners and his outside investors—not to

mention his own savings. “He was troubled when we didn’t invest fast

enough; he was troubled when we made an investment,” said Bain partner

Coleman Andrews. Sorting through possible investments, Romney met weekly

with his young partners, pushing them for deeper analysis and more data

and giving himself the final vote on whether to go forward. They

operated more like a group of bankers carefully guarding their cash than

an aggressive firm eager to embrace giant deals. Some partners

suspected that Romney always had one eye on his political future. “I

always wondered about Mitt, whether he was concerned about the blemishes

from a business perspective or from a personal and political

perspective,” one partner said years later. The partner concluded that

it was the latter. Whereas most entrepreneurs accepted failure as an

inherent part of the game, the partner said, Romney worried that a

single flop would bring disgrace. Every calculation had to be made with

care.

Despite some initial struggles, 1986 would prove to be a

pivotal year for Romney. It started with a most unlikely deal. A former

supermarket executive, Thomas Stemberg, was trying to sell venture

capitalists on what seemed like a modest idea: a cheaper way to sell

paper clips, pens, and other office supplies. The enterprise that would

become the superstore Staples at first met with skepticism. Small and

midsize businesses at the time bought most of their supplies from local

stationers, often at significant markups. Few people saw the

profit-margin potential in selling such homely goods at discount and in

massive volume. But Stemberg was convinced and hired an investment

banker to help raise money. Romney eventually heard Stemberg’s pitch,

and he and his partners dug into Stemberg’s projections. They called

lawyers, accountants, and scores of business owners in the Boston area

to query them on how much they spent on supplies and whether they’d be

willing to shop at a large new store. The partners initially concluded

that Stemberg was overestimating the market. “Look,” Stemberg told

Romney, “your mistake is that the guys you called think they know what

they spend, but they don’t.” Romney and Bain Capital went back to the

businesses and tallied up invoices. Stemberg’s assessment that this was a

hidden giant of a market seemed right after all.

Romney hadn’t

stumbled on Staples on his own. A partner at another Boston firm,

Bessemer Venture Partners, had invited him to the first meeting with

Stemberg. But after that, he took the lead; he finally had his hands on

what looked like a promising start-up. Bain Capital invested $650,000 to

help Staples open its first store, in Brighton, Massachusetts, in May

1986. In all, it invested about $2.5 million in the company. Three years

later, in 1989, Staples sold shares to the public, when it was just

barely turning a profit, and Bain reaped more than $13 million. It was a

big success at the time. Yet it was very modest compared with later

Bain deals that reached into the hundreds of millions of dollars.

For

years Romney would cite the Staples investment as proof that he had

helped create thousands of jobs. And it is true that his foresight in

investing in Staples helped a major enterprise lift off. But neither

Romney nor Bain directly ran the business, though Romney was active on

its board. At the initial public offering, Staples was a firm of 24

stores and 1,100 full- and part-time jobs. Its boom years were still to

come. Romney resigned his seat on the board of directors in 2001 in

preparation for his run for governor. A decade later, the company had

more than 2,200 stores and 89,000 employees.

Assessing claims

about job creation is hard. Staples grew hugely, but the gains were

offset, at least partially, by losses elsewhere: smaller, mom-and-pop

stationery stores and suppliers were being squeezed, and some went out

of business entirely. Ultimately, Romney would approvingly call Staples

“a classic ‘category killer,’ like Toys R Us.” Staples steamrolled the

competition, undercutting prices and selling in large quantities. When

asked about his job-creation claim during the 1994 Senate campaign—that

he had helped create 10,000 jobs at various companies (a claim he

expanded during his 2012 presidential campaign to having “helped to

create tens of thousands” of jobs)—Romney responded with a careful

hedge. He emphasized that he always used the word “helped” and didn’t

take full credit for the jobs. “That’s why I’m always very careful to

use the words ‘help create,’ ” he acknowledged. “Bain Capital, or Mitt

Romney, ‘helped create’ over 10,000 jobs. I don’t take credit for the

jobs at Staples. I helped create the jobs at Staples.”

Howard

Anderson, a professor at M.I.T.’s Sloan School of Management and a

former entrepreneur who has invested with Bain, put it more plainly:

“What you really cannot do is claim every job was because of your good

judgment,” he said. “You’re not really running those organizations.

You’re financing it; you’re offering your judgment and your advice. I

think you can only really claim credit for the jobs of the company that

you ran.”

The same year Romney invested

in Staples—digging into a true start-up—he also inked the biggest

transaction, by far, that Bain Capital had put together until then. And

with this $200 million deal, he waded full-on into the high-stakes

financial arena of the time: leveraged buyouts, or LBOs. Whereas a

venture-capital deal bet on a new business, pursuing an LBO meant

borrowing huge sums of money to buy an established company, typically

saddling the target with big debts. The goal was to mine value that

others had missed, to quickly improve profitability by cutting costs and

often jobs, and then to sell.

Initially, Romney thought that

putting money into young firms “would be just as good as acquiring an

existing company and trying to make it better.” But he found that

“there’s a lot greater risk in a start-up than there is in acquiring an

existing company.” He was much more comfortable in an environment where

the issue wasn’t whether an idea would pan out but whether the numbers

worked. He knew himself, knew that his powers ran less to the creative

than to the analytical; he was not at heart an entrepreneur. Perhaps

that was what led him to push the Pause button at the outset with Bill

Bain. But he now felt ready to take on much bigger financial risks,

mostly by making leveraged bets on existing companies, whose market was

known and whose business plans he could parse and master.

Billions

of dollars were being made in the field of leveraged buyouts in the

roaring 80s, and Romney was fully in the game, continuing to ratchet up

his favored strategy. On the campaign trail in 2011, Romney said his

work had “led me to become very deeply involved in helping other

businesses, from start-ups to large companies that were going through

tough times. Sometimes I was successful and we were able to help create

jobs, other times I wasn’t. I learned how America competes with other

companies in other countries, what works in the real world and what

doesn’t.” It was a vague summary of what was a very controversial type

of business. In his 2004 autobiography, Turnaround, Romney put it

more bluntly: “I never actually ran one of our investments; that was

left to management.” He explained that his strategy was to “invest in

these underperforming companies, using the equivalent of a mortgage to

leverage up our investment. Then we would go to work to help management

make their business more successful.”

Romney’s

phrase, “leverage up,” provides the key to understanding this most

profitable stage of his business career. While putting relatively little

money on the table, Bain could strike a deal using largely debt. That

generally meant that the company being acquired had to borrow huge sums.

But there was no guarantee that target companies would be able to repay

their debts. At Bain, the goal was to buy businesses that were

stagnating as subsidiaries of large corporations and grow them or shake

them up to burnish their performance. Because many of the companies were

troubled, or at least were going to be heavily indebted after Bain

bought them, their bonds would be considered lower-grade, or “junk.”

That meant they would have to pay higher interest on the bonds, like a

strapped credit-card holder facing a higher rate than a person who pays

off purchases more quickly. High-yielding junk bonds were appealing to

investors willing to take on risk in exchange for big payouts. But they

also represented a big bet: if the companies didn’t generate large

profits or could not sell their stock to the public, some would be

crippled by the debt layered on them by the buyout firms.

The

arcane domain of corporate buyouts and junk-bond financing had entered

the public consciousness at the time, and not always in a positive way.

Ivan Boesky, a Wall Street arbitrageur who often bought the stock of

takeover targets, was charged with insider trading and featured on the

cover of Time magazine as “Ivan the Terrible.” Shortly after Romney began working on leveraged deals, a movie called Wall Street

opened. It featured the fictional corporate raider Gordon Gekko, who

justified his behavior by declaring, “I am not a destroyer of companies.

I am a liberator of them! … Greed, for lack of a better word, is good.

Greed is right. Greed works. Greed clarifies, cuts through, and captures

the essence of the evolutionary spirit.”

Romney, of course,

never said that greed is good, and there was nothing of Gekko in his

mores or style. But he bought into the broader ethic of the LBO kings,

who believed that through the aggressive use of leverage and skilled

management they could quickly remake underperforming enterprises. Romney

described himself as driven by a core economic credo, that capitalism

is a form of “creative destruction.” This theory, espoused in the 1940s

by the economist Joseph Schumpeter and later touted by former Federal

Reserve Board chairman Alan Greenspan, holds that business must exist in

a state of ceaseless revolution. A thriving economy changes from

within, Schumpeter wrote in his landmark book, Capitalism, Socialism and Democracy,

“incessantly destroying the old one, incessantly creating a new one.”

But as even the theory’s proponents acknowledged, such destruction could

bankrupt companies, upending lives and communities, and raise questions

about society’s role in softening some of the harsher consequences.

Romney,

for his part, contrasted the capitalistic benefits of creative

destruction with what happened in controlled economies, in which jobs

might be protected but productivity and competitiveness falters. Far

better, Romney wrote in his book No Apology, “for governments to

stand aside and allow the creative destruction inherent in a free

economy.” He acknowledged that it is “unquestionably stressful—on

workers, managers, owners, bankers, suppliers, customers, and the

communities that surround the affected businesses.” But it was necessary

to rebuild a moribund company and economy. It was a point of view he

would stick with in years ahead. Indeed, he wrote a 2008 op-ed piece for

The New York Times opposing a federal bailout for automakers that the newspaper headlined, let detroit go bankrupt.

His advice went unheeded, and his prediction that “you can kiss the

American automotive industry goodbye” if it got a bailout has not come

true.

Thanks to a highly leveraged but successful takeover and

turnaround of a wheel-rim maker, Accuride, Bain Capital became a hot

property. So much money poured into Romney’s second investment fund that

the firm had to turn away investors. Romney set out to raise $80

million and received offers totaling $150 million. The partners settled

on $105 million, half of it from wealthy customers of a New York bank.

During a break at a photo shoot for a brochure to attract investors, the

Bain partners playfully posed for a photo that showed them flush with

cash. They clutched $10 and $20 bills, stuffed them into their pockets,

and even clenched them in their grinning teeth. Romney tucked a bill

between his striped tie and his buttoned suit jacket. Everything was

different now.

Valley of the LBO Kings

It

was time for another road show, but the days of soliciting prospects

for scarce cash in obscure locales were mostly over. This time Romney

and his partners headed to Beverly Hills, California. Arriving at the

intersection of Rodeo Drive and Wilshire Boulevard, they headed to the

office of Michael Milken, the canny and controversial junk-bond king, at

his company, Drexel Burnham Lambert. Romney knew Milken was able to

find buyers for the high-yield, high-risk bonds that were crucial to the

success of many leveraged-buyout deals. At the time of Romney’s visit,

it was widely known that Drexel and Milken were under investigation by

the Securities and Exchange Commission. But Drexel was still the big

player in the junk-bond business, and Romney needed the financing.

Romney

had come to Drexel to obtain financing for the $300 million purchase of

two Texas department-store chains, Bealls and Palais Royal, to form

Specialty Retailers, Inc. On September 7, 1988, two months after Bain

hired Drexel to issue junk bonds to finance the deal, the S.E.C. filed a

complaint against Drexel and Milken for insider trading. Romney had to

decide whether to close a deal with a company ensnared in a growing

clash with regulators. The old Romney might well have backed off; the

newly assertive, emboldened Mitt decided to press ahead.

Romney’s

deal with Drexel turned out well for both him and Bain Capital, which

put $10 million into the retailer and financed most of the rest of the

$300 million deal with junk bonds. The newly constituted company, later

known as Stage Stores, refocused in 1989 on its small-town,

small-department-store roots. Seven years later, in October 1996, the

company successfully sold shares to the public at $16 a share. By the

following year, the stock had climbed to a high of nearly $53, and Bain

Capital and a number of its officers and directors sold a large part of

their holdings. Bain made a $175 million gain by 1997. It was one of the

most profitable leveraged buyouts of the era.

Romney sold at

just the right time. Shares plunged in value the next year amid

declining sales at the stores. The department-store company filed for

Chapter 11 bankruptcy protection in 2000, struggling with $600 million

in debt, and a reorganized company emerged the following year. So ended

the story of a deal that Romney would not be likely to cite on the

campaign trail: the highly leveraged purchase, financed with junk bonds

from a firm that became infamous for its financial practices, of a

department-store company that had subsequently gone into bankruptcy. But

on the Bain balance sheet, and on Romney’s, it was a huge win.

Not

every deal worked out so well for Romney and his investors. Bain

invested $4 million in a company called Handbag Holdings, which sold

pocketbooks and other accessories. When a major customer stopped buying,

the company failed and 200 jobs were lost. Bain invested $2.1 million

in a bathroom-fixtures company called PPM and lost nearly all of it. An

investment in a company called Mothercare Stores also didn’t pan out;

the firm had eliminated a hundred jobs by the time Bain dumped it.

Fellow Bain partner Robert White said Bain lost its $1 million and

blamed “a difficult retail environment.”

In some cases, Bain

Capital’s alternative strategy of buying into companies also ended in

trouble. In 1993, Bain bought GST Steel, a maker of steel-wire rods, and

later more than doubled its $24 million investment. The company

borrowed heavily to modernize plants in Kansas City and North

Carolina—and to pay out dividends to Bain. But foreign competition

increased and steel prices fell. GST Steel filed for bankruptcy and shut

down its money-losing Kansas City plant, throwing some 750 employees

out of work. Union workers there blamed Bain, then and now, for ruining

the company, upending their lives, and devastating the community.

Then,

in 1994, Bain invested $27 million as part of a deal with other firms

to acquire Dade International, a medical-diagnostics-equipment firm,

from its parent company, Baxter International. Bain ultimately made

nearly 10 times its money, getting back $230 million. But Dade wound up

laying off more than 1,600 people and filed for bankruptcy protection in

2002, amid crushing debt and rising interest rates. The company, with

Bain in charge, had borrowed heavily to do acquisitions, accumulating

$1.6 billion in debt by 2000. The company cut benefits for some workers

at the acquired firms and laid off others. When it merged with Behring

Diagnostics, a German company, Dade shut down three U.S. plants. At the

same time, Dade paid out $421 million to Bain Capital’s investors and

investing partners.

The amount of money

now being earned at Bain Capital was skyrocketing, and much of it came

from a handful of giant deals. During Romney’s 15 years there, the firm

invested about $260 million in its 10 top deals and reaped a nearly $3

billion return. That was about three-quarters of its overall profit on

roughly 100 transactions during Romney’s tenure. In one of his most

specific explanations of how he made his fortune, in his autobiography, Turnaround,

Romney wrote that most of the companies he invested in were ones that

“no one has heard of—TRW’s credit services, the Yellow Pages of Italy.”

Those weren’t just any two deals. They were two of the most lucrative of

Romney’s career, and luck played a big part in both. A mere seven weeks

after buying TRW, Romney and his partners flipped the company. Bain’s

$100 million investment returned at least $300 million. The second deal

cited by Romney took longer but involved even more good timing and luck.

It began with a renowned Italian investor named Phil Cuneo, who had the

idea of buying the Italian version of the Yellow Pages. It seemed a

solid investment in a firm with a staid and stable business model. But

mere months after closing the deal, Cuneo and his Bain associates

realized that they had acquired a company that might benefit from the

surging interest in dot-com businesses; the Yellow Pages company owned a

Web-based directory that had the potential to be the Italian version of

America Online or Yahoo. In just under three years, in September 2000,

the partners sold the investment, earning a windfall that far exceeded

anyone’s initial expectations. Bain’s $51.3 million investment in the

Italian Yellow Pages returned at least $1.17 billion, according to a

Romney associate familiar with the deal. There is no public

documentation of how the profits were distributed, but at that time at

least 20 percent of the return would have gone to Bain Capital. Of that,

Romney’s typical payout was then 5 to 10 percent. That means this one

obscure deal would have given him a profit of $11 million to $22

million. If Romney made a side investment in the deal, as was standard

among Bain partners, he would have made even larger gains. One Romney

associate said Romney’s total profit could have been as much as $40

million. (A Romney spokesman did not respond to questions about the

deal.)

It was those kinds of deals that enabled Bain Capital to

report the highest returns in the business in the 1990s. Romney’s own

net worth would grow to at least $250 million, and maybe much more, a

trove that would enable him to foot a large part of the bill for his

2008 presidential campaign. Asked about a report that his wealth at one

point reached as high as $1 billion, Romney said, “I’m not going to get

into my net worth. No estimates whatsoever.”

For

15 years, Romney had been in the business of creative destruction and

wealth creation. But what about his claims of job creation? Though Bain

Capital surely helped expand some companies that had created jobs, the

layoffs and closures at other firms would lead Romney’s political

opponents to say that he had amassed a fortune in part by putting people

out of work. The lucrative deals that made Romney wealthy could exact a

cost. Maximizing financial return to investors could mean slashing

jobs, closing plants, and moving production overseas. It could also mean

clashing with union workers, serving on the board of a company that ran

afoul of federal laws, and loading up already struggling companies with

debt.

There is a difference between companies run by buyout

firms and those rooted in their communities, according to Ross Gittell, a

professor at the University of New Hampshire’s Whittemore School of

Business and Economics. When it comes to buyout firms, he said, “the

objective is: Make money for investors. It’s not to maximize jobs.”

Romney, in fact, had a fiduciary duty to investors to make as much money

as possible. Sometimes everything worked out perfectly; a change in

strategy might lead to cost savings and higher profits, and Bain cashed

in. Sometimes jobs were lost, and Bain cashed in or lost part or all of

its investment. In the end, Romney’s winners outweighed his losers on

the Bain balance sheet. Marc Wolpow, a former Bain partner who worked

with Romney on many deals, said the discussion at buyout companies

typically does not focus on whether jobs will be created. “It’s the

opposite—what jobs we can cut,” Wolpow said. “Because you had to

document how you were going to create value. Eliminating redundancy, or

the elimination of people, is a very valid way. Businesses will die if

you don’t do that. I think the way Mitt should explain it is, if we

didn’t buy these businesses and impose efficiencies on them, the market

would have done it with disastrous consequences.”

WASHINGTON -- Poor women who stay at home to raise their children should be given federal assistance for child care so that they can enter the job market and "have the dignity of work," Mitt Romney said in January, undercutting the sense of extreme umbrage he showed when Democratic strategist Hilary Rosen quipped last week that Ann Romney had not "worked a day in her life."

The remark, made to a Manchester, N.H., audience, was unearthed by MSNBC's "Up w/Chris Hayes," and aired during the 8 a.m. hour of his show Sunday.

Ann Romney and her husband's campaign fired back hard at Rosen following her remark. "I made a choice to stay home and raise five boys. Believe me, it was hard work," Romney said on Twitter.

On Sunday, Romney spokeswoman Amanda Henneberg told The Huffington Post in an email, "Moving welfare recipients into work was one of the basic principles of the bipartisan welfare reform legislation that President Clinton signed into law. The sad fact is that under President Obama the poverty rate among women rose to 14.5 percent in 2011, the highest rate in 17 years. The Obama administration's economic policies have been devastating to women and families."

Mitt Romney, however, judging by his January remark, views stay-at-home moms who are supported by federal assistance much differently than those backed by hundreds of millions in private equity income. Poor women, he said, shouldn't be given a choice, but instead should be required to work outside the home to receive Temporary Assistance for Needy Families benefits. "[E]ven if you have a child 2 years of age, you need to go to work," Romney said of moms on TANF.

Recalling his effort as governor to increase the amount of time women on welfare in Massachusetts were required to work, Romney noted that some had considered his proposal "heartless," but he argued that the women would be better off having "the dignity of work" -- a suggestion Ann Romney would likely take issue with.

"I wanted to increase the work requirement," said Romney. "I said, for instance, that even if you have a child 2 years of age, you need to go to work. And people said, 'Well that's heartless.' And I said, 'No, no, I'm willing to spend more giving day care to allow those parents to go back to work. It'll cost the state more providing that daycare, but I want the individuals to have the dignity of work.'"

Regardless of its level of dignity, for Ann Romney, her work raising her children would not have fulfilled her work requirement had she been on TANF benefits. As HuffPost reported Thursday:

Romney's January view echoes a remark he made in 1994 during his failed Senate campaign. "This is a different world than it was in the 1960s when I was growing up, when you used to have Mom at home and Dad at work," Romney said, as shown in a video posted by BuzzFeed's Andrew Kaczynski. "Now Mom and Dad both have to work whether they want to or not, and usually one of them has two jobs."

This article has been updated to reflect comment from the Romney campaign.